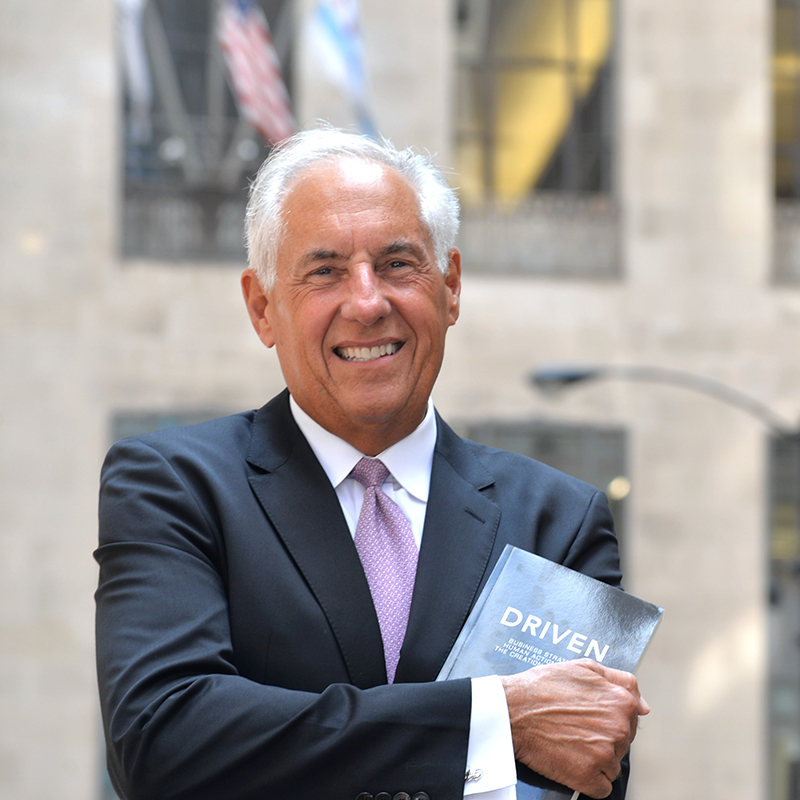

DePaul University Ezerski Chair and Accountancy Professor Mark L. Frigo

DePaul University Ezerski Chair and Accountancy Professor Mark L. FrigoWhat skills do financial executives need to manage risk

successfully in a rapidly changing business environment?

To answer this question, DePaul University Ezerski Chair and

Accountancy Professor Mark L. Frigo and Paul L. Walker, Schiro/Zurich Chair in

Enterprise Risk Management at St. John’s University, conducted interviews with

financial executives from top companies.

“The scope of CFOs’ responsibilities toward enterprise risk

management has been expanding,” Frigo says. “We wanted to identify the

capabilities that CFOs need to have today, as well as tomorrow, to manage risk

and anticipate disruptions before they impact organizations.”

CFOs and other executives from Microsoft, Oracle, Boeing,

Dow Chemical, Martin Marietta, Coca-Cola and Pitney Bowes were among the

leaders interviewed. Based on these interviews, the researchers identified four

things financial executives must be able to do:

Proactively recognize the sources of enterprise disruption.

Proactively recognize the sources of enterprise disruption.

- Develop insights and an enterprise-wide understanding of their organizations’ risk profiles and capabilities to manage risk.

- Think and communicate strategically.

- Create a forward-thinking, strategic finance organization.

Frigo and Walker’s research report, “The Strategic Financial

Executive: Managing Enterprise Risk in a Disruptive World,” was sponsored by

Grant Thornton and published by the Financial Executives Research Foundation. Click

here to read a report summary.

Learn more about

DePaul’s MS in Enterprise Risk Management.